Self-billed Credit Note, Debit Note and Refund

Once you have submitted an invooce to the LHDN MyInvois Portal as Self-billed E-Invoice, you are not allowed to edit or delete the invoice. If you need to make adjustments, you must do so using either a Supplier Credit Note or Supplier Debit Note. These adjustments must also be submitted to the LHDN MyInvois Portal.

Additionally, if you receive a Supplier Credit Note and later receive a refund from your supplier, you will also need to submit a Supplier Refund to the portal to reflect this transaction.

Submitting Self-billed Credit Note, Debit Note, and Refund Note:

To submit a Supplier Credit Note, Supplier Debit Note, or Supplier Refund, the LHDN MyInvois Portal requires you to specify which original Self-billed E-Invoice (whether individual or consolidated) the adjustment is referring to.

Follow the steps below to submit your adjustment transaction:

- Create the Transaction

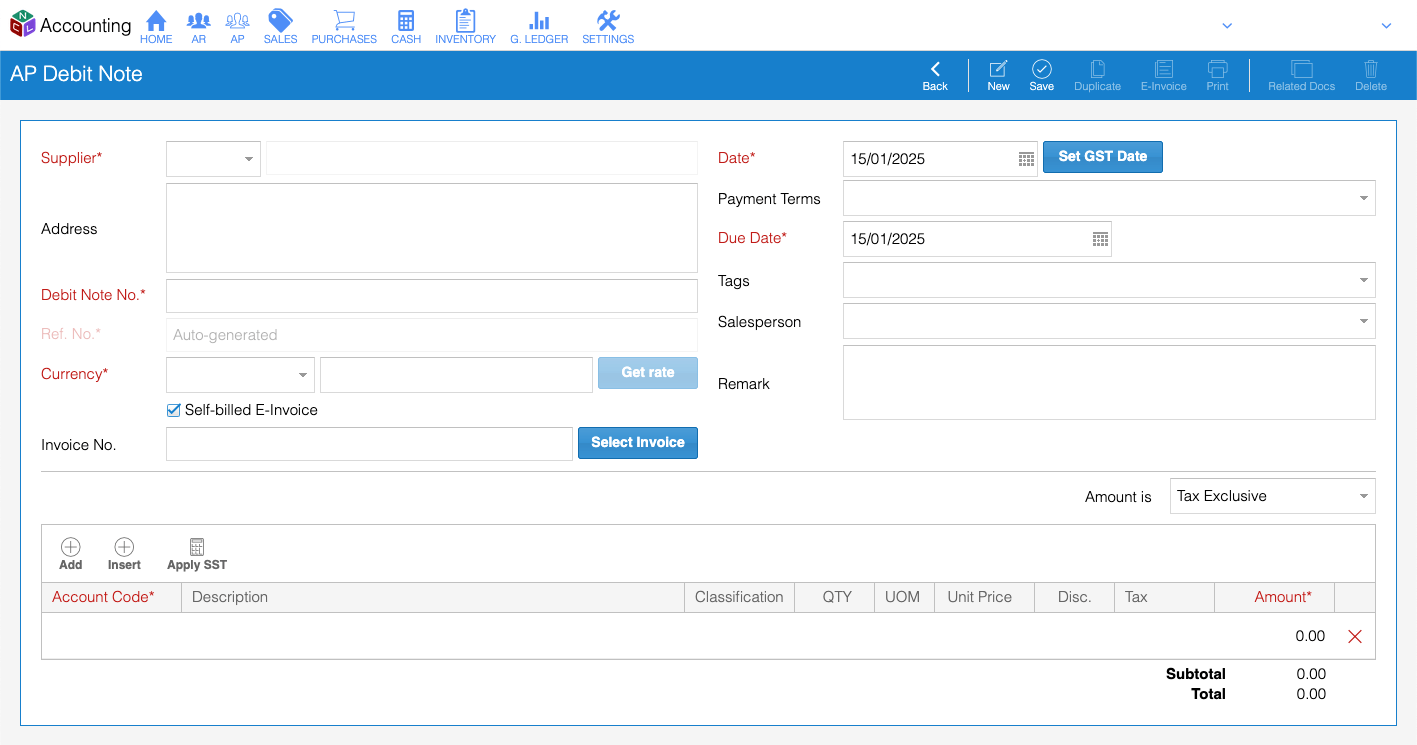

Begin by creating the Supplier Credit Note, Supplier Debit Note, or Supplier Refund as you would any standard transaction. This includes selecting the supplier, account/item, and the adjustment amount.

- Select the Original Self-billed E-Invoice

While creating the transaction, you’ll need to check the Self-Billed E-Invoice option and select the original Self-billed E-Invoice from the list. This list will display all previously submitted invoices, whether individual or consolidated, so you can choose the one to which the adjustment relates.

- Select Classification Code

For each detail line, select the appropriate classification code.

- Submit the Adjustment

Click the E-Invoice button and select View Information from the dropdown menu. This will open the E-Invoice Information window.

Review the details, make any necessary updates, and click Submit to send the transaction to the MyInvois Portal.

After submitting the transaction, you have a 72 hours window to cancel the submission if necessary, allowing you to make any corrections within that time frame.