Consolidate Self-billed E-Invoices

To submit a Consolidated Self-billed E-Invoice, you must first enable this option in your E-Invoice Settings. In accordance with LHDN regulations, all transactions marked as Self-billed E-Invoices and not submitted to the LHDN MyInvois Portal must be submitted as a Consolidated Self-billed E-Invoice before the 7th of the following month.

Steps to Submit a Consolidated Self-billed E-Invoice:

- Access the Consolidated Self-billed E-Invoice Section:

Navigate to G.Ledger > Consolidated Self-billed E-Invoice, and click on the New button to create a new submission.

- Retrieve Invoices:

Choose the Currency and Date Range for the invoices you need to submit as part of the Consolidated Self-billed E-Invoice. This will filter the invoices to match your selection.

- Include Cancelled/Invalid Invoices (Optional):

If you need to submit invoices that were previously submitted as Self-billed E-Invoices but are now marked as Cancelled or Invalid, check the box labeled "Include Cancelled/Invalid E-Invoice" to include these in the submission.

- Select the Invoices to Submit:

From the retrieved list of invoices, tick the boxes next to those you wish to include in the Consolidated Self-billed E-Invoice.

For optimal processing, it is advised to submit no more than 500 invoices per submission, as the LHDN MyInvois Portal has data transfer limitations for each batch.

- Submit the Consolidated Self-billed E-Invoice:

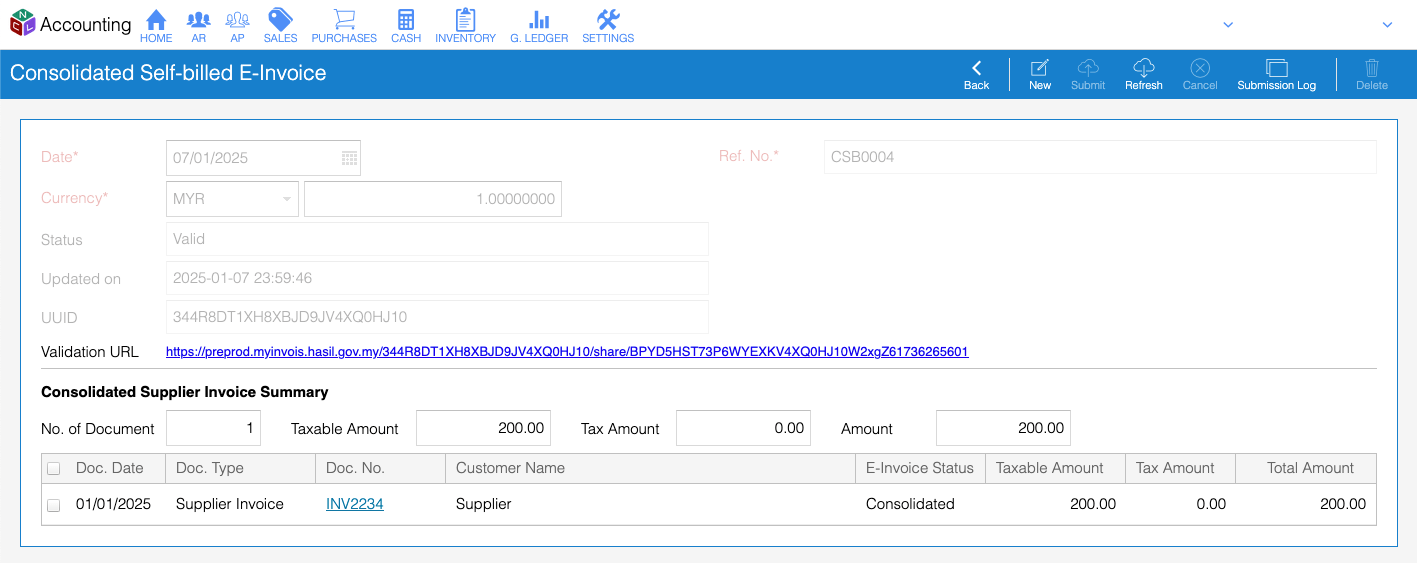

Once you have selected the invoices, click Submit. After successful submission, a Validation URL will be provided. You can use this URL to verify the status of the Self-billed E-Invoice on the MyInvois Portal.

If needed, you can cancel the Consolidated Self-billed E-Invoice within 72 hours of submission. This option allows you to make changes or correct errors after submission.